Multiple Choice

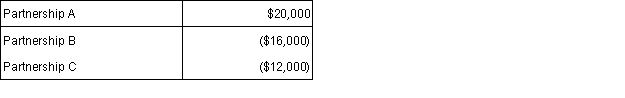

Spencer has an ownership interest in three passive activities. In the current tax year, the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

A) $0.

B) $12,000.

C) $16,000.

D) $20,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: There is no difference between regular tax

Q4: Every taxpayer who calculates depreciation on his

Q7: If a taxpayer disposes of a passive

Q8: How much,in rental losses,can an individual earning

Q9: An equipment leasing activity is not subject

Q22: Which of the following itemized deductions is

Q34: Claudia invested $50,000 cash in the C&S

Q48: In 2015, Ethan contributes cash of $50,000

Q59: The passive activity loss rules require income/loss

Q64: Which of the following decreases a taxpayer's