Multiple Choice

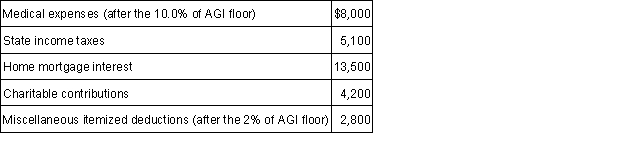

Cal reported the following itemized deductions on his 2015 tax return. His AGI for 2015 was $85,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total itemized deductions.

A) $0.

B) $17,700.

C) $25,700.

D) $33,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The term "passive activity" includes any activity

Q11: Gifts to charity are not allowed for

Q19: To be considered a material participant in

Q25: The AMT tax rate for individuals is

Q31: Libby owns and operates Mountain View Inn,a

Q47: Most real estate debt meets the requirements

Q62: The at-risk amount is increased each tax

Q65: Generally,the gains and losses recognized for regular

Q67: Jonathan is married, files a joint return,

Q68: Baird has four passive activities. The following