Essay

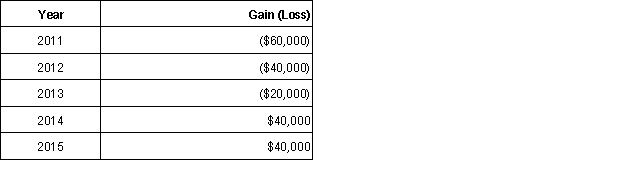

In 2011, Lindsay's at-risk amount was $50,000 at the beginning of the year. Lindsay's shares of income and losses from the activity were as follows (ignore passive loss rules):  In 2015, what amount of income or loss will Lindsay report from this activity?

In 2015, what amount of income or loss will Lindsay report from this activity?

Correct Answer:

Verified

The following amounts would be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: An equipment leasing activity is not subject

Q10: The term "passive activity" includes any activity

Q12: For AMT purposes,the standard deduction and personal

Q15: The initial amount considered at-risk is the

Q19: To be considered a material participant in

Q22: Which of the following itemized deductions is

Q25: The AMT tax rate for individuals is

Q31: Libby owns and operates Mountain View Inn,a

Q33: A loss must first be allowed under

Q54: Bailey owns a 20% interest in a