Multiple Choice

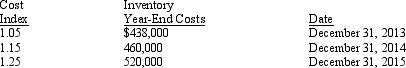

Exhibit 7-5 Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2013, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2014, using the dollar-value LIFO method would be

A) $400,000

B) $402,000

C) $406,000

D) $424,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What three difficulties does dollar-value LIFO overcome

Q6: A manufacturing company typically has how many

Q16: On August 1, Micro Encoders, Inc. had

Q18: Morris Corp. uses dollar-value LIFO. Certain information

Q20: What is the cost of goods sold

Q22: On June 1, Dollar Hardware, Inc. had

Q41: The LIFO conformity rule allows a company

Q76: What is the difference between FOB shipping

Q82: In a period of rising prices LIFO

Q90: Goods in transit shipped FOB shipping point