Essay

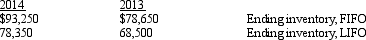

Cabinets for Less uses FIFO for internal reporting purposes and LIFO for financial and income tax purposes. At the end of 2014, the following information was obtained from the inventory records:  Required:

Required:

Prepare the necessary entry to convert to LIFO at the end of 2013.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Which one of the following statements is

Q30: Which one of the following statements is

Q32: For companies that have little change in

Q39: In a period of falling prices, FIFO

Q46: The term LIFO reserve refers to<br>A) a

Q47: Exhibit 7-5 Sullivan Produce Co. switched from

Q50: The following information was obtained from the

Q51: Near the end of 2015, Spruce Co.

Q61: The basic criterion for including items in

Q71: Which of the following inventory cost flow