Multiple Choice

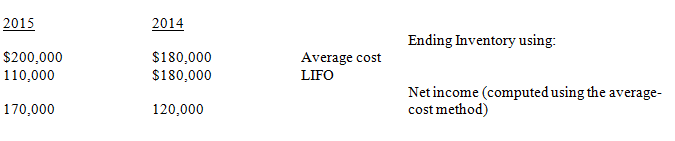

Betty Company began operations in 2014 and uses the average cost method in costing its inventory. In 2015, Betty is investigating a change to the LIFO method. Before making that determination, Betty desires to determine what effect such a change will have on net income. Betty has compiled the following information:

Assume a 40% tax rate.

If Betty adopted LIFO in 2015, net income would be

A) $ 80,000

B) $116,000

C) $170,000

D) $224,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: What are the three type of accounting

Q23: During a year-end evaluation of the financial

Q30: When a company has a counterbalancing error,

Q32: Exhibit 22-6 North Company has a fiscal

Q33: Which of the following accounting changes is

Q34: An item that would not be accounted

Q44: If a company adopts a new accounting

Q71: Changes in accounting entities that require retrospective

Q74: In situations where the change in accounting

Q124: Which of the following is the proper