Essay

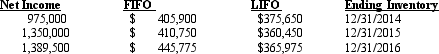

In 2016, Bevins Company decided to change from LIFO to FIFO due to better representation of the flow of inventory and costs. Bevins started the business in 2014. Bevin's tax rate is 35%. The following analysis was provided by management:  Required:

Required:

1) Prepare the journal entry necessary to record the change.

2) What amount of net income would Bevins report in 2014, 2015, and 2016?

Correct Answer:

Verified

Correct Answer:

Verified

Q9: What is a change in reporting entity

Q92: Current GAAP defines three types of changes:

Q94: Exhibit 22-2 On January 1, 2015, Nathan,

Q95: On January 1, 2014, Roy Company acquired

Q98: A change in a reporting entity is

Q99: On January 1, 2014, the Master Company

Q101: All of the following would be reported

Q107: A change in accounting principle because an

Q126: Which of the following is a counterbalancing

Q130: Which of the following should be reported