Essay

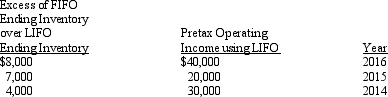

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2016. The following data were available:

The income tax rate is 35%. The company began operations on January 1, 2014, and has paid no dividends since inception.

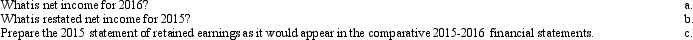

Required:

Answer the following questions relating to the 2015-2016 comparative financial statements.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Margaret Company purchased equipment on January 1,

Q4: On January 1, 2014, Dawn Company bought

Q4: Which of the following statements does not

Q5: Exhibit 22-1 On January 1, 2014, the

Q6: The correct 2014 net income for Magness

Q20: The Bronson Company changed its method of

Q39: A change from LIFO to FIFO should

Q40: Which of the following is a noncounterbalancing

Q48: If consolidated statements are presented for the

Q70: Generally accepted methods of accounting for a