Multiple Choice

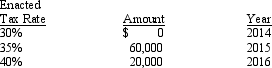

During its first year of operations ending on December 31, 2014, the Dakota Company reported pretax accounting income of $600,000. The only difference between taxable income and accounting income was $80,000 of accrued warranty costs. These warranty costs are expected to be paid as follows:

Assuming an income tax rate of 30% in 2014, Dakota should report income tax expense on its 2014 income statement in the amount of

A) $175,000

B) $180,000

C) $185,000

D) $204,000

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Smyrna Company had financial and taxable incomes

Q27: A company would determine whether to recognize

Q28: What two issues does FASB have to

Q29: When congress makes a tax law or

Q34: The Pink Diamonds Company installs fire alarm

Q36: The Mishka Corporation reported the following income

Q43: Which of the following would not result

Q44: Which one of the following statements regarding

Q69: The amount owed the IRS is recorded

Q90: What are the three types of permanent