Multiple Choice

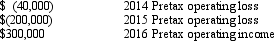

Moore Company reported the following operating results during its first three years of operations:

No permanent or temporary differences occurred during these fiscal periods. Assuming an income tax rate of 35%, Moore should report a current income tax liability as of December 31, 2016, in the amount of

A) $ 0

B) $21,000

C) $84,000

D) $91,000

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Revenue from installment sales is recognized in

Q46: Permanent differences impact<br>A)current deferred taxes<br>B)current tax liabilities<br>C)deferred

Q47: What three groups are measuring and timing

Q55: Income tax expense as determined by GAAP

Q56: The following information relates to the Kill

Q57: For the year ended December 31, 2014,

Q63: Jefferson Corporation reported the following pretax and

Q64: Under IFRS ,valuation allowances for deferred tax

Q64: Lewes Company appropriately uses the installment sales

Q65: The Wyatt Company reports the following for