Multiple Choice

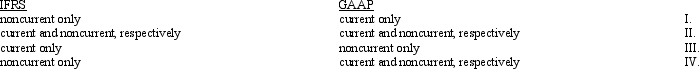

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q25: Which of the following statements regarding current

Q30: Which of the following transactions would typically

Q46: Discuss what criteria a company should employ

Q51: All of the following involve a temporary

Q90: Which of the following are required disclosures

Q92: What conclusion did FASB come to in

Q93: At the end of its first year

Q95: At the end of its first

Q98: Lakeland Corporation reported the following pretax (and

Q108: What disclosures are required for "uncertain tax