Multiple Choice

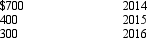

On January 1, 2014, Reids, Inc. sold a risky investment for $1,400 that had been purchased for $1,000. It was decided to use the cost recovery method of revenue recognition. Cash collections on accounts receivable related to the asset were as follows:  Which of the following represent the realized gross profit that Reids should recognize for each year?

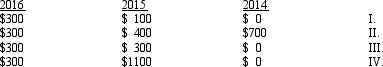

Which of the following represent the realized gross profit that Reids should recognize for each year?

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Correct Answer:

Verified

Q13: What conditions must be met for the

Q14: Accrual method is usually associated with<br>A) revenue

Q15: GAAP requires the completed-contract method to be

Q16: Aberdeen Company sold an asset for $450,000

Q17: Exhibit 17-4 The following information is provided

Q19: Exhibit 17-4 The following information is provided

Q20: A company may not use the installment

Q21: The deferral method is usually associated with<br>A)

Q23: Which of the following revenue recognition methods

Q45: The proportional performance method is usually associated