Multiple Choice

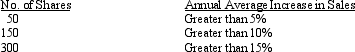

Exhibit 15-6 On January 1, 2014, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was $16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.

-Refer to Exhibit 15-6. The estimated total compensation cost will be

A) $ 55,000

B) $123,750

C) $ 27,500

D) $247,500

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A corporation acquired a copyright by issuing

Q15: Which one of the following equations is

Q23: Exhibit 15-4 On January 1, 2014, Masters,

Q26: When recording the conversion of preferred stock

Q29: List four transactions that comprise a corporation's

Q32: Under the fair value method, if an

Q33: How is Paid-in Capital from Share Options

Q42: Miscellaneous fees arising from the issuance of

Q46: Which of the following represents shares of

Q79: For share appreciation rights SARs) compensation plans