Multiple Choice

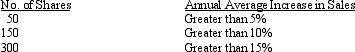

Exhibit 15-6 On January 1, 2014, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was $16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

On the grant date, the company estimates the annual average sales increase will be 14%.

-Refer to Exhibit 15-6. In 2015, the company determined that the actual annual average increase was 16%. The compensation expense for 2015 will be

A) $123,750

B) $247,500

C) $ 82,500

D) $ 55,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following types of corporations

Q45: Which of the following can be accounted

Q48: How will stockholders' equity and net income

Q49: Exhibit 15-8 On January 1, 2013, Margarita

Q53: Exhibit 15-9 Groundcover, Inc. had never had

Q87: For a stock appreciation rights (SAR)compensation plan,

Q88: What are share based compensation plans?

Q91: There is disagreement among accountants as to

Q96: The accounting method that is used for

Q115: When share options are exercised by an