Essay

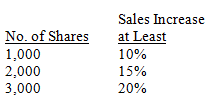

On January 1, 2013, Biggs Company granted a performance-based stock option plan to 40 executives to buy a maximum of 3,000 shares each of its $10 par common stock at $30 a share. The fair value per option is $8. The terms of the plan, which has a three-year service and vesting period, are based on the following scale:

Biggs expects an annual employee turnover rate of 3%, and the company initially anticipates an increase in sales during the service period of 18%. By the end of 2015, the actual sales increase is 17%.

a.Compute the estimated total compensation cost.

b.Compute the annual compensation expense for each of the three years.

c.Prepare the January 1, 2016, entry when 10 executives exercise their options.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: In most states, it is illegal to

Q47: Why would a corporation want to repurchase

Q52: Norwalk Corporation issued 10,000 shares of $50

Q67: On January 1, 2015, sixty executives are

Q70: Mars Corp. has 15,000 shares of $5

Q73: The following information is provided for Wolf

Q75: Under IFRS companies are allowed to revalue

Q76: When accounting for a fixed compensatory share

Q104: Smith Corp. has both Class A and

Q141: Assume common stock is issued to employees