Essay

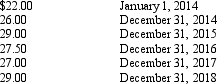

On January 1, 2014, the Jim Corporation granted 50,000 stock appreciation rights (SARs) to the company's president, Jim Darling. Jim will be entitled to receive cash or common stock or some combination of cash and common stock for the difference between the quoted market price at the date of exercise and a $20 option price per SAR. It is assumed that Jim will elect to receive cash when he exercises his SARs. The service period is three years, and he may exercise his SARs during the period January 1, 2017, through December 31, 2018. The market prices per share of Jim Corporation's common stock are as follows:

On December 31, 2018, Jim Darling exercises his 5,000 SARs and elects to receive cash.

Required:

a.Prepare the journal entries to record each year's compensation expense related to the SARs.

b.Prepare the December 31, 2018 entry to record the exercise of the 50,000 SARs.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: State laws established the concept of legal

Q19: When a company acquires treasury stock, what

Q25: A corporation is a legal entity<br>A) held

Q37: Corporate stockholders can only lose the amount

Q56: Noncompensatory share purchase plans are utilized to

Q126: Exhibit 15-5 On January 1, 2013,

Q128: Righty, Inc., entered into a stock subscription

Q129: For a compensatory share option plan, a

Q131: Listed below are various classifications of corporations.

Q134: Sully Sports Cars Co. entered into a