Essay

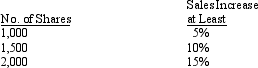

On January 1, 2015, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2019.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan (2015 through 2019).

Correct Answer:

Verified

January 1, 2015:

Mem...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Mem...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Current GAAP recommends that the fair value

Q6: A corporation's legal capital<br>A) is established to

Q48: Companies can reacquire their own stock to

Q81: Under the par value method of accounting

Q84: Which one of the following statements is

Q88: Exhibit 15-2 Lawrence, Inc., entered into a

Q93: On January 1, Maxine Corp. entered into

Q94: The following information is provided for Miller

Q96: Exhibit 15-8 On January 1, 2013, Margarita

Q146: An open corporation does not allow the