Essay

The following events relate to Mathers Corporation's issue of convertible debentures:

•On January 1, 2012, the Mathers Corporation issued $500,000 of 12% convertible bonds for $460,000. The bonds are due on January 1, 2022, and interest is paid on July 1 and January 1. Each $1,000 bond is convertible into 30 shares of common stock with a par value of $1 per share. On the date of bond issuance, a share of common stock was selling at $24.

•On January 2, 2014, 12% convertible bonds with a face value of $300,000 were converted into common stock. The market value of the common stock on the date of conversion was $40 per share. Mathers uses the straight-line method to amortize premiums and discounts.

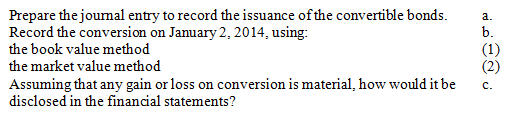

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The bond interest expense reflected on the

Q16: On July 1, 2013, Rio Corporation issued

Q18: On January 1, 2013, the Keller Co.

Q20: Siena sold $120,000 of 6% bonds for

Q21: If a company redeems bonds from any

Q22: Briggs Industries, Inc. issued $900,000 of 8%

Q23: On January 1, 2014, the Porter Corporation

Q34: An unsecured bond is called a<br>A)debenture bond<br>B)mortgage

Q63: When the market rate of interest is

Q185: Barley, Inc. sold $30,000 of 8% bonds