Multiple Choice

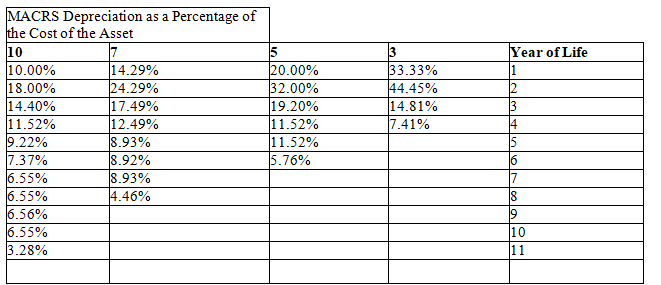

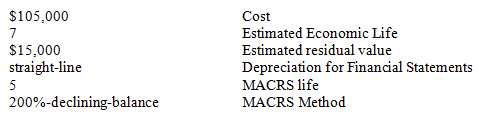

Exhibit 11-05 Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, 2013.

-Refer to Exhibit 11-05, what amount of depreciation would be recorded on the income tax returns for year 5?

A) $6,048

B) $15,000

C) $12,096

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Redeau Company has been depreciating certain assets

Q25: Assets sold on or before the 15th

Q27: What costs can be capitalized as part

Q59: If a company purchases an asset within

Q64: List the time based allocation methods of

Q65: The Roberto Company purchased a limo for

Q66: On January 1, 2014, Lefty, Inc. purchased

Q68: Under the MACRS principles the residual value

Q97: Which one of the following statements is

Q103: Which one of the following statements is