Essay

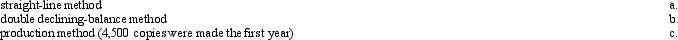

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the

Correct Answer:

Verified

b. Double...

b. Double...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Intangible assets differ from property, plant, and

Q44: The calculation for annual depreciation using the

Q46: The Bacon Company acquired new machinery with

Q62: Capital expenditures are costs of acquiring, constructing,

Q68: Expected useful life is<br>A) calculated when the

Q116: During construction of a building, the cost

Q117: Computer equipment was acquired at the beginning

Q135: Capital expenditures are costs that are charged

Q168: Residual value is incorporated in the initial

Q206: Costs associated with normal research and development