Essay

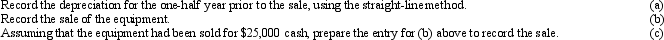

Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

Correct Answer:

Verified

Correct Answer:

Verified

Q9: The cost of computer equipment does include

Q12: An asset was purchased for $58,000 and

Q18: All leases are classified as either<br>A) capital

Q38: On October 1, Sebastian Company acquired new

Q46: The Bacon Company acquired new machinery with

Q50: The double-declining-balance method is an accelerated depreciation

Q108: A building with an appraisal value of

Q109: On April 15, Compton Co. paid $1,350

Q168: Residual value is incorporated in the initial

Q206: Costs associated with normal research and development