Essay

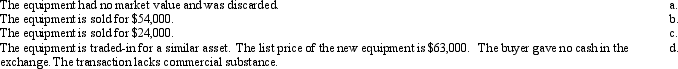

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions.

Journal

Journal

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q27: On July 1, 2010, Howard Co. acquired

Q28: On December 31, Strike Company has decided

Q33: A number of major structural repairs

Q41: A used machine with a purchase price

Q101: When old equipment is traded in for

Q113: A fixed asset with a cost of

Q116: The amount of the depreciation expense for

Q137: The term applied to the amount of

Q144: The double-declining-balance depreciation method calculates depreciation each

Q215: Functional depreciation occurs when a fixed asset