Essay

Fully amortizing installment note payable (mortgage)

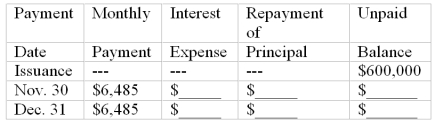

On October 31, 2011, Seldon Company incurs a 30-year $600,000 mortgage liability in conjunction with the purchase of a motel. This mortgage is payable in equal monthly installments of $6,485, which include interest computed at an annual rate of 12%. The first monthly payment is made on November 30, 2011. This mortgage is fully amortizing over 360 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided. In addition, answer the questions which follow.

(a) With respect to this mortgage, Seldon's 2011 income statement includes interest expense of $_______________, and Seldon's balance sheet at December 31, 2011, includes a total liability for this mortgage of _______________. (Do not separate into current and long-term portions.)

(b) The aggregate monthly cash payments Seldon will make over the 30-year life of the mortgage amount to $_______________.

(c) Over the 30-year life of the mortgage, the amount Seldon will pay for interest amounts to $_______________.

Correct Answer:

Verified

1 $600,000 x .12 x 1/12 = 6,000

2. $6,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1 $600,000 x .12 x 1/12 = 6,000

2. $6,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: [The following information applies to the questions

Q21: An operating lease:<br>A)Creates an asset and a

Q25: Fully amortizing installment notes<br>When Sue Meadow purchased

Q29: The current portion of long-term debt should

Q33: Deferred income taxes result from:<br>A) The fact

Q37: The amount of bond interest expense recognized

Q52: Interest expense on this bond issue reported

Q59: When an installment note is structured as

Q75: [The following information applies to the questions

Q103: A company with a fully funded pension