Essay

Recording transactions directly in T accounts; trial balance

On July 20, Mollie Rose began a new business called MR Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during July.

(A.) Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.) Purchased land and a small building for $450,000, paying $165,000 cash and signing a note payable for the balance. The land was considered to be worth $240,000 and the building $210,000.

(C.) Purchased office equipment for $30,000 from Quality Interiors, Inc. Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.) Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers. Mollie agreed to make payment to Spokes, Inc. within 10 days.

(E.) Paid in full the account payable to Spokes, Inc.

(F.) Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

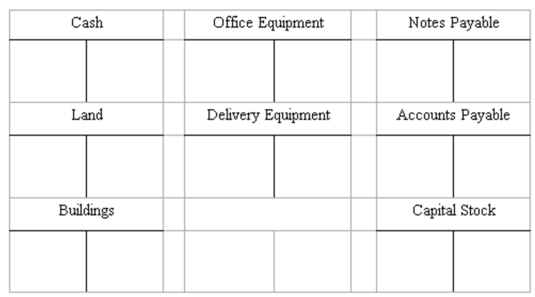

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at July 31 by completing the form provided.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The reason that revenue is recorded by

Q37: In a ledger,debit entries cause:<br>A)Increases in owners'

Q44: Journalize and post basic transactions<br>Precision Grading Co.

Q45: Master Equipment has a $17,400 liability to

Q45: A trial balance proves that equal amounts

Q48: Recording transactions in T accounts; trial balance<br>On

Q69: Transactions are recorded in the general journal

Q110: A trial balance that is out of

Q123: If a company purchases equipment on account:<br>A)Assets

Q130: Green Systems sold and delivered modems to