Multiple Choice

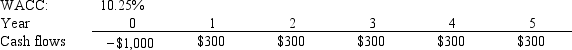

Robbins Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

Correct Answer:

Verified

Correct Answer:

Verified

Q14: When evaluating mutually exclusive projects, the modified

Q15: The IRR method is based on the

Q16: Which of the following statements is CORRECT?

Q17: Westwood Painting Co.is considering a project that

Q18: Which of the following statements is CORRECT?<br>A)

Q20: Wiley's Wire Products is considering a project

Q21: Because "present value" refers to the value

Q22: One advantage of the payback method for

Q23: Which of the following statements is CORRECT?<br>A)

Q24: Which of the following statements is CORRECT?<br>A)