Multiple Choice

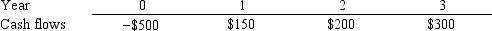

Worthington Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 2.03 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.03 years

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q62: Reed Enterprises is considering a project that

Q63: Kiley Electronics is considering a project that

Q64: Which of the following statements is CORRECT?<br>A)

Q65: Carolina Company is considering Projects S and

Q66: For a project with one initial cash

Q68: No conflict will exist between the NPV

Q69: Assuming that their NPVs based on the

Q70: An increase in the firm's WACC will

Q71: When considering two mutually exclusive projects, the

Q72: Which of the following statements is CORRECT?