Multiple Choice

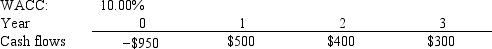

Patterson Co.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $54.62

B) $57.49

C) $60.52

D) $63.54

E) $66.72

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Markman & Sons is considering Projects S

Q8: Which of the following statements is CORRECT?

Q9: Conflicts between two mutually exclusive projects occasionally

Q10: A project's IRR is independent of the

Q11: Which of the following statements is CORRECT?<br>A)

Q13: Dickson Co.is considering a project that has

Q14: When evaluating mutually exclusive projects, the modified

Q15: The IRR method is based on the

Q16: Which of the following statements is CORRECT?

Q17: Westwood Painting Co.is considering a project that