Multiple Choice

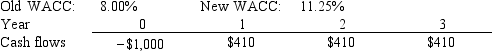

Corner Jewelers, Inc.recently analyzed the project whose cash flows are shown below.However, before the company decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) -$59.03

B) -$56.08

C) -$53.27

D) -$50.61

E) -$48.08

Correct Answer:

Verified

Correct Answer:

Verified

Q49: The IRR of normal Project X is

Q50: Consider projects S and L.Both have normal

Q51: Spence Company is considering a project that

Q52: The WACC for two mutually exclusive projects

Q53: Which of the following statements is CORRECT?<br>A)

Q55: The NPV and IRR methods, when used

Q56: The NPV method's assumption that cash inflows

Q57: Projects S and L are both normal

Q58: Suppose a firm relies exclusively on the

Q59: Which of the following statements is CORRECT?<br>A)