Multiple Choice

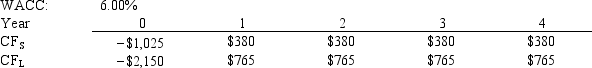

Murray Inc.is considering Projects S and L, whose cash flows are shown below.These projects are mutually exclusive, equally risky, and not repeatable.The CEO wants to use the IRR criterion, while the CFO favors the NPV method.You were hired to advise Murray on the best procedure.If the wrong decision criterion is used, how much potential value would Murray lose?

A) $188.68

B) $198.61

C) $209.07

D) $219.52

E) $230.49

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Projects C and D both have normal

Q83: Which of the following statements is CORRECT?<br>A)

Q84: The internal rate of return is that

Q85: Which of the following statements is NOT

Q86: The phenomenon called "multiple internal rates of

Q88: Projects S and L are equally risky,

Q89: You are on the staff of O'Hara

Q90: Which of the following statements is CORRECT?

Q91: McGlothin Inc.is considering a project that has

Q92: You are considering two mutually exclusive, equally