Multiple Choice

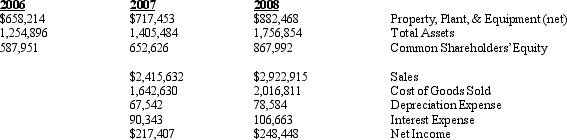

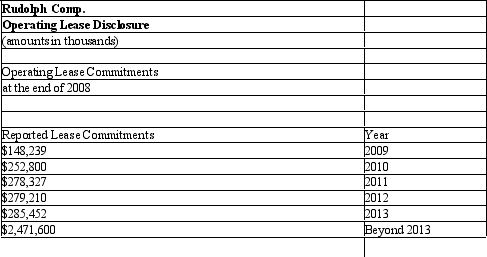

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

A) increase

B) decrease

C) no effect

D) unable to determine

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Income tax expense consists of two components,the

Q17: A derivative has one or more _,which

Q22: Optical Networks Optical Networks is a leading

Q24: One of the conditions that must be

Q25: Optical Networks Optical Networks is a leading

Q27: NOTE: The following multiple choice questions require

Q47: Which of the following is not one

Q55: Which of the following accounts would not

Q58: Many firms use derivative instruments to hedge

Q77: The accumulated benefit obligation measures:<br>A) the pension