Multiple Choice

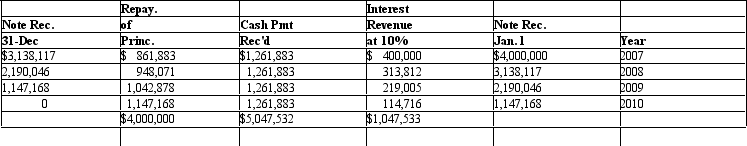

Folio Corp. Folio Corp. sold a paper machine to Library Inc. on January 1, 2007. The sale price of the machine was $4,000,000 and the machine cost $3,200,000 for Folio to manufacture. Library will make four payments at the end of each year, beginning with 2007, of $1,261,883 each. The four payments of $1,261,883 when discounted at 10% have a present value of $4,000,000. An amortization table appears below: If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

If Folio Corp. is uncertain that it will collect all four payments from Library Inc. and uses the cost recovery method of accounting for revenue recognition what amount of gross profit should Folio recognize in 2007 from the sale?

A) $0

B) $861,883

C) $172,377

D) $800,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Firms recognize an impairment loss when the

Q7: _ is primarily a question of timing.

Q36: Discuss how firms should account for intangible

Q37: Folio Corp. Folio Corp. sold a paper

Q39: Tiger Company has consistently used the percentage-of-completion

Q39: Although LIFO generally provides higher quality earnings

Q42: Finale Company's accounting manager decided to start

Q42: Which of the following would not be

Q43: Assume that Playground Corp. has agreed to

Q53: Under current accounting rules an asset is