Essay

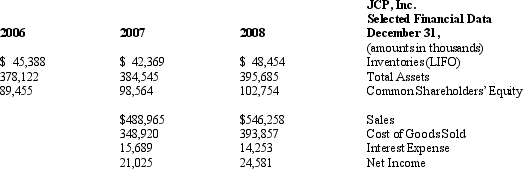

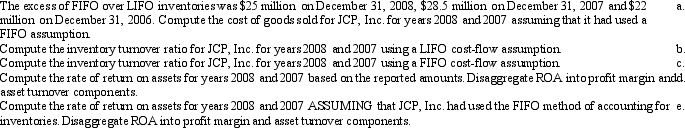

JCP, Inc. is a major producer of printing equipment. JCP uses a LIFO cost-flow assumption for inventories. The company's tax rate is 35%. Below is selected financial data for the company.

Required:

Required:

Correct Answer:

Verified

Required:

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Application of the LIFO and FIFO inventory

Q2: A contractor would not use _ method

Q11: When cash collectibility is uncertain the _

Q28: The process of allocating the historical cost

Q36: A company that uses LIFO will find

Q41: When cash collectibility is uncertain,a firm using

Q43: One sign that a company may be

Q57: The difference between the economic resources received

Q63: Under the accrual method of accounting,when a

Q70: A company that uses LIFO will experience