Multiple Choice

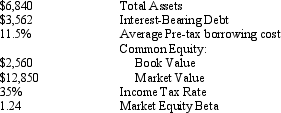

Zolar Corp. The following data pertains to Zolar Corp., a manufacturer of ball bearings (dollar amounts in millions) : Assuming that riskless rate is 4.2% and the market premium is 6.2% calculate Zolar's cost of equity capital:

Assuming that riskless rate is 4.2% and the market premium is 6.2% calculate Zolar's cost of equity capital:

A) 10.4%

B) 7.69%

C) 11.89%

D) 2.0%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Suppose a firm has a market beta

Q13: When deriving the equity value of a

Q16: If dividend projections include the effect of

Q21: For each of the following companies determine

Q22: WACC<br>An analyst wants to value the sum

Q25: Zolar Corp. The following data pertains to

Q25: Provide the rationale for using expected dividends

Q26: For each of the following scenarios determine

Q30: Zolar Corp. The following data pertains to

Q46: In theory,the value of a share of