Multiple Choice

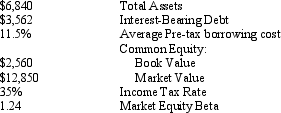

Zolar Corp. The following data pertains to Zolar Corp., a manufacturer of ball bearings (dollar amounts in millions) : Assume that Zolar is a potential leveraged buyout candidate. Assume that the buyer intends to put in place a capital structure with that has 70 percent debt with a pre tax borrowing cost of 14 percent and 30 percent common equity. Compute the weighted average cost of capital for Zolar based on the new capital structure.

Assume that Zolar is a potential leveraged buyout candidate. Assume that the buyer intends to put in place a capital structure with that has 70 percent debt with a pre tax borrowing cost of 14 percent and 30 percent common equity. Compute the weighted average cost of capital for Zolar based on the new capital structure.

A) 20.63%

B) 12.56%

C) 13.01%

D) 9.94%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: To determine the appropriate weights to use

Q7: One rational for using expected dividends in

Q12: Implementing a dividend valuation model to determine

Q14: In some valuation scenarios, such as a

Q18: Zonk Corp.<br>The following data pertains to

Q19: Under the assumption of clean surplus accounting,how

Q20: Which of the following is not a

Q30: Normally,valuation methods are designed to produce reliable

Q41: Because the market equity beta reflects the

Q44: Dividends measure the cash that _ ultimately