Essay

Parson Services Corporation was organized on January 1, Year 8.The unadjusted trial balance on December 31, Year 8 after recording transactions that occurred during Year 8 is as follows.

Parson Services Corporation

Unadjusted Trial Balance

December 31 , Year 8

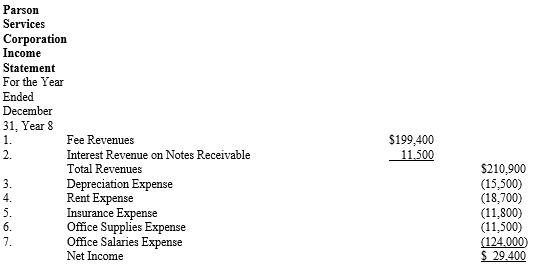

Below is the income statement for Year 8 that was prepared after making appropriate adjusting entries for Year 8.

Required:

Required:

Give the adjusting entries that Parson Services Corporation must have made at the end of Year 8 for each of the seven income statement accounts.You may express the adjusting entries either in the form of journal entries or T accounts.

Correct Answer:

Verified

Note that Cash is seldom involved in an ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Expenses measure the outflow of net assets

Q59: The Supplies account balance at the beginning

Q60: Which of the following is/are true?<br>A)Revenues measure

Q61: The post-closing trial balance of the

Q63: The stockholders' equity of a firm can

Q65: The result of closing entries is that

Q67: Once revenue and expense accounts serve their

Q68: Before preparing the balance sheet and income

Q69: The equation that describes the relationship between

Q93: A manufacturing firm has manufacturing costs which