Essay

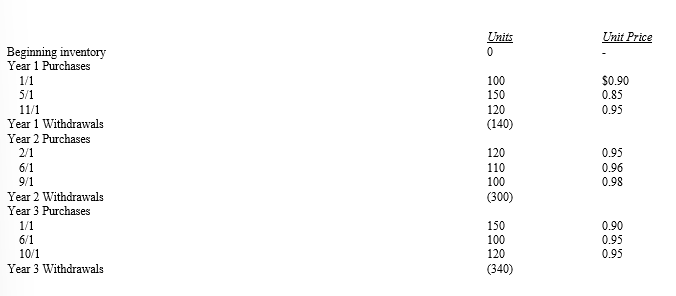

Using U.S.GAAP, a merchandising firm is trying to decide between using LIFO or FIFO for an inventory cost flow assumption.The firm had inventory purchases and sales over 3 years as follows:

The firm estimates that using LIFO will cost the firm $50 for additional clerical work. The tax rate for all years is 30%. Net income before cost of goods sold for each year is as follows:

Year 1 - $1,000

Year 2 - $2,000

Year 3 - $2,500

Required:

a. What is net income after taxes under each method for years 1 through 3?

b. Which method will result in a higher after tax cash flow for each year?

Correct Answer:

Verified

Correct Answer:

Verified

Q149: Which of the following is/are not true?<br>A)Firms

Q150: Income before taxes for financial reporting usually

Q151: How do firms account for goodwill?

Q152: As part of their normal course of

Q153: Firms sometimes acquire bonds or capital stock

Q155: Explain the accounting for the issuance of

Q156: Earnings per share is a measure of<br>A)cash

Q157: Which of the following is/are true regarding

Q158: When do firms recognize revenue?

Q159: Firms sometimes acquire bonds or capital stock