Essay

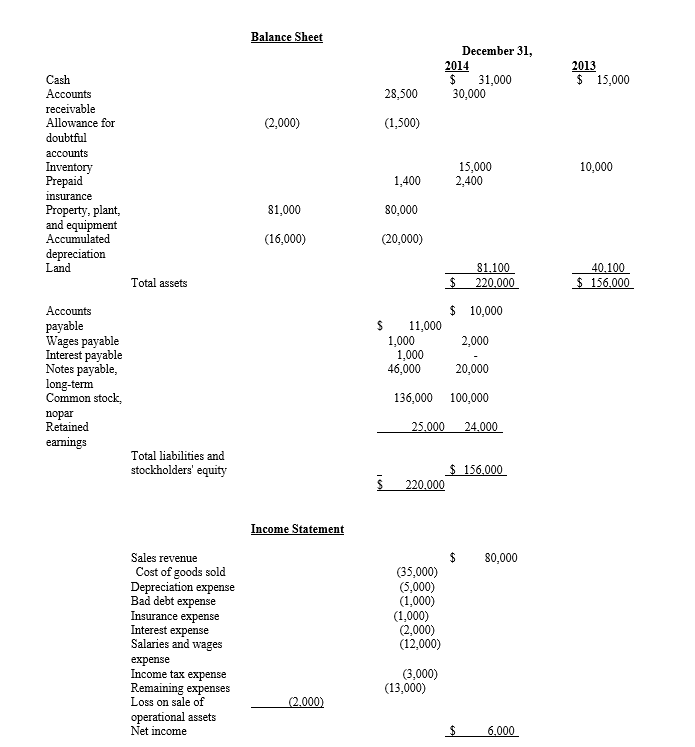

Financial information for Price Company at December 31, 2014, and for the year then ended, are presented below:

Additional information:

Additional information:

1. On December 31, 2013, Newton acquired 25 percent of Trent Corporation’s common stock for $137,500. On that date, the carrying value of Trent’s net assets and liabilities (which approximated fair value) was $550,000. Trent reported income of $60,000 for the year ended December 31, 2014. No dividend was paid on Trent’s common stock during the year.

2. During 2014, Newton loaned $150,000 to Dalton Company, an unrelated entity. Dalton made the first semi-annual principal payment of $15,000, plus interest at 10 percent, on October 1, 2014.

3. On January 2, 2014, Newton sold equipment costing $30,000, with a carrying value of $17,500, for $20,000 cash.

4. On January 2, 2014, Newton entered into a capital lease for an office building. The present value of the annual rental payments is $200,000, which equals the fair value of the building. Newton made the first lease payment of $30,000 when due on January 2, 2015.

5. Newton’s net income for 2014 was $180,000.

6. Newton declared and paid cash dividends for 2014 and 2013 as follows:

Required:

Prepare the statement of cash flows using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: The product life-cycle concept from microeconomics and

Q65: The last step in the accounting record-keeping

Q66: Kendrick Company began the current year

Q67: Cash flow from _ activities includes purchases

Q68: Which of the following items involving current

Q70: Glass Corporation retired $7,500,000 of long-term debt

Q71: Discuss the effects of transactions involving derivatives

Q72: In order to explain the change in

Q73: (CMA adapted, Jun 94 #4) Spring Corporation,

Q74: Most, but not all, firms report cash