Essay

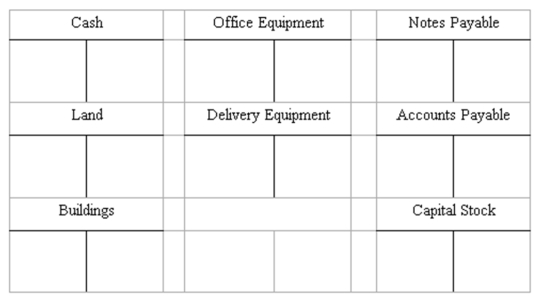

Recording transactions directly in T accounts; trial balance

On July 20, Mollie Rose began a new business called MR Printing, which provides typing, duplicating, and printing services. The following six transactions were completed by the business during July.

(A.) Issued to Rose 1,000 shares of capital stock in exchange for her investment of $200,000 cash.

(B.) Purchased land and a small building for $450,000, paying $165,000 cash and signing a note payable for the balance. The land was considered to be worth $240,000 and the building $210,000.

(C.) Purchased office equipment for $30,000 from Quality Interiors, Inc. Paid $17,000 cash and agreed to pay the balance within 60 days.

(D.) Purchased a motorcycle on credit for $3,400 to be used for making deliveries to customers. Mollie agreed to make payment to Spokes, Inc. within 10 days.

(E.) Paid in full the account payable to Spokes, Inc.

(F.) Borrowed $30,000 from a bank and signed a note payable due in six months.

Instructions

(A.) Record the above transactions directly in the T accounts below. Identify each entry in a T account with the letter shown for the transaction. This exercise does not call for the use of a journal.

(B.) Prepare a trial balance at July 31 by completing the form provided.

MR PRINTING

MR PRINTING

Trial Balance

July 31, 20

Debit Credit

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Recognizing revenue when it is earned and

Q40: "I was just following orders" is an

Q70: The general ledger is sometimes called the

Q72: In a trial balance prepared on June

Q76: On January 5, 2009, total liabilities are:<br>A)

Q78: Net income is:<br>A) The excess of debits

Q85: Which of the following errors would be

Q93: [The following information applies to the questions

Q98: The sequence of accounting procedures used to

Q123: If a company purchases equipment on account:<br>A)Assets