Essay

In its 2018 annual report to shareholders, Black Inc. disclosed the following information about income taxes.

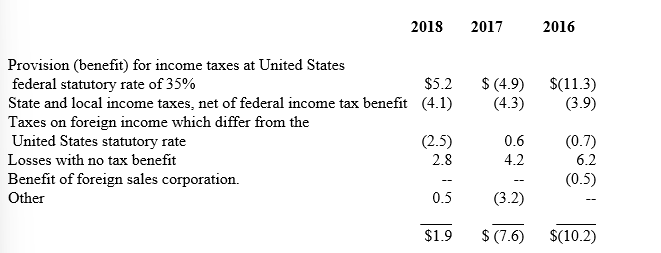

A reconciliation of income taxes computed at the United States federal statutory income tax rate (35%) to the provision (benefit) for income taxes reflected in the Consolidated Statement of Operations for the years ended December 31, 2018, 2017, and 2016 is as follows ($ in millions):

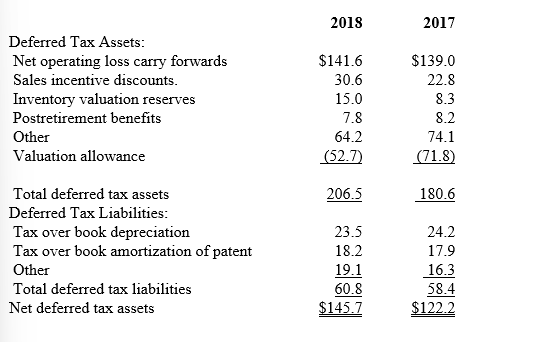

The significant components of the net deferred tax assets at December 31, 2018 and 2017 were as follows ($ in millions):

-Why are the depreciation and patent amortization listed as deferred tax liabilities?

Correct Answer:

Verified

The depreciation for tax purposes is acc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Listed below are 5 terms followed by

Q111: Woody Corp. had taxable income of $8,000

Q113: A temporary difference originates in one period

Q114: The Kelso Company had the following operating

Q115: Listed below are 5 terms followed by

Q117: Typical Corp. reported a deferred tax liability

Q118: Giada Foods reported $940 million in income

Q119: The following information is for James Industries'

Q120: Which of the following causes a temporary

Q121: Listed below are five independent situations. For