Essay

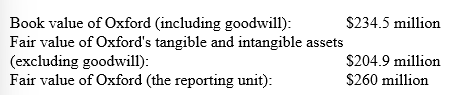

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Correct Answer:

Verified

An impairment loss must be rec...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: In December of 2018, XL Computer's internal

Q30: On January 1, 2018, Morrow Inc. purchased

Q31: Why is land not depreciated? What are

Q32: On January 1, 2016, Al's Sporting Goods

Q33: Listed below are five terms followed by

Q35: An asset that has an estimated physical

Q36: Qualcomm Inc. engages in the development, design,

Q37: Which of the following typically refers to

Q38: Accounting for impairment losses:<br>A) Involves a two-step

Q39: The replacement of a major component increased