Essay

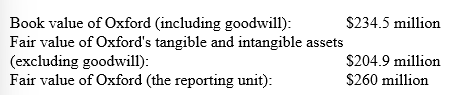

In 2017, Dooling Corporation acquired Oxford Inc. for $250 million, of which $50 million was attributed to goodwill. At the end of 2018, Dooling's accountants derive the following information for a required goodwill impairment test:

-Assume the same facts as above, except that the fair value of Oxford (the reporting unit) is $225 million.

Required: Determine the amount, if any, of the goodwill impairment loss that Dooling must recognize on these assets.

Correct Answer:

Verified

An impairment loss must be recognized if...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Listed below are five terms followed by

Q49: Alou Corporation reported the following information at

Q50: The three factors in cost allocation of

Q51: Losses on the cash sales of property,

Q52: Zvinakis Mining Company paid $200,000 for the

Q54: Which of the following types of subsequent

Q55: The process of allocating the cost of

Q56: Wilson Inc. owns equipment for which it

Q57: If an intangible asset has a legal

Q58: The allocation base for an asset is:<br>A)