Essay

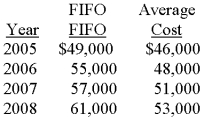

Ramsgate Company has used the FIFO method for inventory valuation since it began business in 2005, but has elected to change to the average cost method starting in 2008. Year-end inventory valuations under each method are shown below:

Required:

What journal entry, if any, would Ramsgate record in 2008 for the cumulative effect of the change in accounting principle (ignore income taxes)?

Correct Answer:

Verified

No cumulative effect of the accounting c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The conventional cost-to-retail percentage is:<br>A)82.6%.<br>B)66.7%.<br>C)71.9%.<br>D)75.8%.66.7%

Q18: To use the dollar-value LIFO retail method

Q19: To the nearest thousand, estimated ending inventory

Q21: In applying the LCM rule, the inventory

Q23: Portman Inc. uses the conventional retail inventory

Q24: In the following questions, inventory

Q25: Howard's Supply Co. suffered a fire loss

Q50: Briefly explain what is meant by "market"

Q68: Under the conventional retail method, which of

Q81: The gross profit method and retail method