Multiple Choice

Figure 8-19

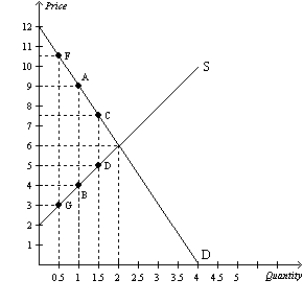

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-19.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

A) increase government revenue and increase the deadweight loss from the tax.

B) increase government revenue and decrease the deadweight loss from the tax.

C) decrease government revenue and increase the deadweight loss from the tax.

D) decrease government revenue and decrease the deadweight loss from the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Which of the following ideas is the

Q16: Suppose the tax on automobile tires is

Q17: Figure 8-23.The figure represents the relationship between

Q19: Which of the following events always would

Q21: Figure 8-23.The figure represents the relationship between

Q22: Figure 8-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-21

Q23: A decrease in the size of a

Q24: Suppose that the market for large,64-ounce soft

Q25: The higher a country's tax rates,the more

Q130: Suppose the federal government doubles the gasoline