Multiple Choice

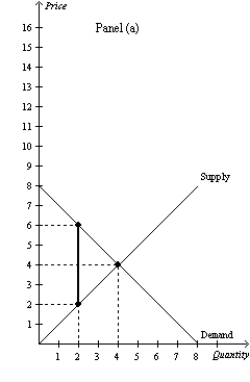

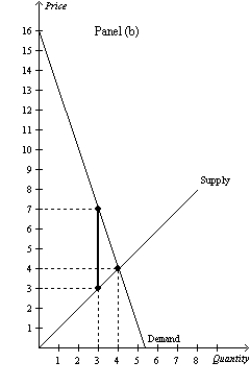

Figure 8-15

-Refer to Figure 8-15.Panel (a) and Panel (b) each illustrate a $4 tax placed on a market.In comparison to Panel (a) ,Panel (b) illustrates which of the following statements?

A) When demand is relatively inelastic,the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic,the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic,the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic,the deadweight loss of a tax is larger than when supply is relatively inelastic.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The Social Security tax is a tax

Q34: Economists generally agree that the most important

Q36: The amount of deadweight loss that results

Q37: Suppose a tax is imposed on baseball

Q38: Taxes on labor have the effect of

Q40: Taxes on labor encourage all of the

Q42: Assume the price of gasoline is $2.40

Q43: The less freedom people are given to

Q44: The deadweight loss from a tax<br>A)does not

Q201: If the labor supply curve is very