Multiple Choice

Figure 8-9

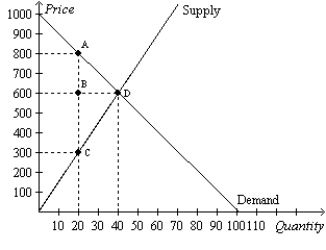

The vertical distance between points A and C represents a tax in the market.

-Refer to Figure 8-9.The imposition of the tax causes the quantity sold to

A) increase by 20 units.

B) increase by 500 units.

C) decrease by 20 units.

D) decrease by 500 units.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: When a tax on a good is

Q72: Figure 8-9<br>The vertical distance between points A

Q73: Figure 8-6<br>The vertical distance between points A

Q74: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q75: Figure 8-3<br>The vertical distance between points A

Q77: A tax levied on the sellers of

Q78: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q79: Figure 8-8<br>Suppose the government imposes a $10

Q80: The supply curve for whiskey is the

Q81: Deadweight loss is the<br>A)decline in total surplus