Essay

Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual report to shareholders:

Trading securities consist of $54,608,000 and $41,707,000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available-for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity.

Cold Cat Inc.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Years Ended March 31,

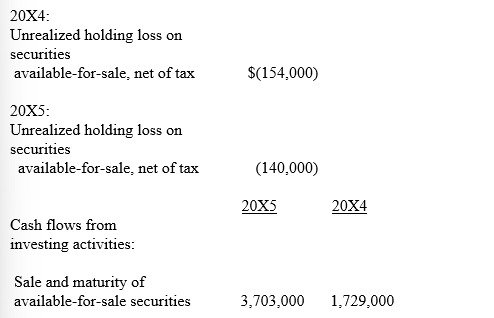

Accumulated Other Comprehensive Income changed by the following amounts:

NOTE B - SHORT-TERM INVESTMENTS

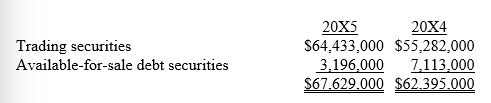

Short-term investments consist primarily of a diversified portfolio of municipal and corporate bonds and are classified as follows at March 31:

In its 20X4 annual report, Cold Cat disclosed, "The contractual maturities of available-for-sale debt securities at March 31, 20X4, are $3,573,000 within one year and $3,340,000 from one year through five years."

-How much did Cold Cat actually receive from the sale of available-for-sale securities during 20X5?

Correct Answer:

Verified

$130,000 (i.e., $3,7...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q158: On January 12th, 2018 Jefferson Corporation purchased

Q159: For trading securities, unrealized holding gains and

Q160: Jaycom Enterprises has invested its excess cash

Q161: The equity method is in many ways

Q162: If Pop Company exercises significant influence over

Q164: On July 1, 2018, Silverwood Company purchased

Q165: The income statement reports changes in fair

Q166: Dicker Furriers purchased 1,000 bonds of Loose

Q167: When the equity method of accounting for

Q168: IFRS No. 9 is a standard that