Essay

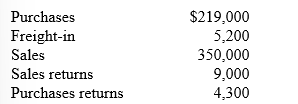

Henderson Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of July was $122,500. The following information for the month of August was available from company records:

In addition, the controller is aware of $10,000 of inventory that was stolen during August from one of the company's warehouses.

Required:

1. Calculate the estimated inventory at the end of August, assuming a gross profit ratio of 30%.

2. Calculate the estimated inventory at the end of August, assuming a markup on cost of 25%.

Correct Answer:

Verified

1.

Beginning inventory (from records) $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Beginning inventory (from records) $1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Losses on reduction to NRV may be

Q65: Montana Co. has determined its year-end

Q66: Orlando Company has used the average

Q67: Charleston Company has elected to use the

Q68: Under the conventional retail method, which of

Q70: Green Acres Co. has elected to use

Q71: Data related to the inventories of Kimzey

Q72: Harlequin Co. adopted the dollar-value LIFO retail

Q73: Benny's Bed Co. uses a periodic inventory

Q74: The second step, when using dollar-value LIFO