Essay

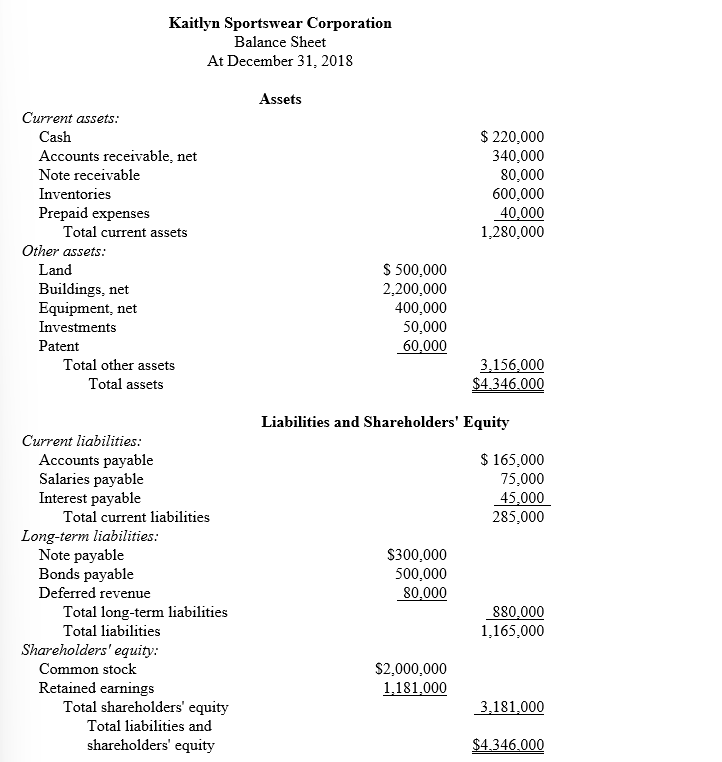

You recently joined the internal auditing department of Kaitlyn Sportswear Corporation. As one of your first assignments, you are examining a balance sheet prepared by a staff accountant.

In the course of your examination you uncover the following information pertaining to the balance sheet:

1. The land and buildings represent the corporate headquarters and manufacturing facilities.

2. The note receivable is due in 2020. The balance of $80,000 includes $5,000 of accrued interest. The next interest payment is due in July 2019.

3. The note payable is due in installments of $50,000 per year. Interest on both the notes and bonds is payable annually.

4. The company's investments consist of marketable equity securities of other corporations. Management does not intend to liquidate any investments in the coming year.

5. Deferred revenue will be recognized ratably (equally) over the next two years.

Required:

Identify and explain the deficiencies in the statement prepared by the company's accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note.

Correct Answer:

Verified

1. Accounts receivable - if material, th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Match the following terms with their definitions.<br>-Accounts

Q88: Match the following terms with their definitions.<br>-Retained

Q120: Liquidity refers to:<br>A) The amount of cash

Q121: List the circumstances under which land would

Q121: Indicate the type of each ratio listed

Q123: Long-term solvency refers to:<br>A) The efficiency with

Q124: Listed below are ten terms followed by

Q126: Management's Report on Internal Control Over Financial

Q128: Janson Corporation Co.'s trial balance included the

Q130: You are reviewing the December 31, 2018,