Essay

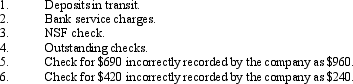

Identify each of the following reconciling items as (a) an addition to the cash balance according to the bank statement, (b) deduction from the cash balance according to the bank statement, (c) an addition to the cash balance according to the company's records, or (d) a deduction from the cash balance according to the company's records. Assume that none of the transactions reported by bank debit and credit memos have been recorded by the company. Also, indicate by writing (Entry) those items that will require a journal entry in the company's accounts.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following would be subtracted

Q3: Which of the following would not be

Q8: A business that requires all cash payments

Q10: The Sarbanes-Oxley Act of 2002 was passed

Q11: Consider the following journal entry made by

Q44: A compensating balance occurs when a bank

Q100: Internal control is enhanced by separating the

Q130: Receipts from cash sales of $3,200 were

Q145: In preparing a bank reconciliation, the amount

Q180: For efficiency of operations and better control