Multiple Choice

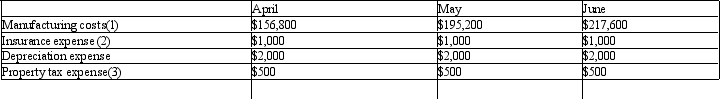

Finch Company began its operations on March 31 of the current year. Finch Co. has the following projected costs:  (1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of April are:

A) $122,600

B) $120,600

C) $123,100

D) $121,100

Correct Answer:

Verified

Correct Answer:

Verified

Q155: Which of the following would not be

Q156: At the beginning of the period, the

Q157: Woodpecker Co. has $296,000 in accounts receivable

Q158: Tanya Inc.'s static budget for 10,000 units

Q159: Production estimates for July are as follows:

Q161: Nuthatch Corporation began its operations on September

Q162: For February, sales revenue is $700,000; sales

Q163: Based on the following production and sales

Q164: The budgeted finished goods inventory and cost

Q165: An August sales forecast projects 6,000 units